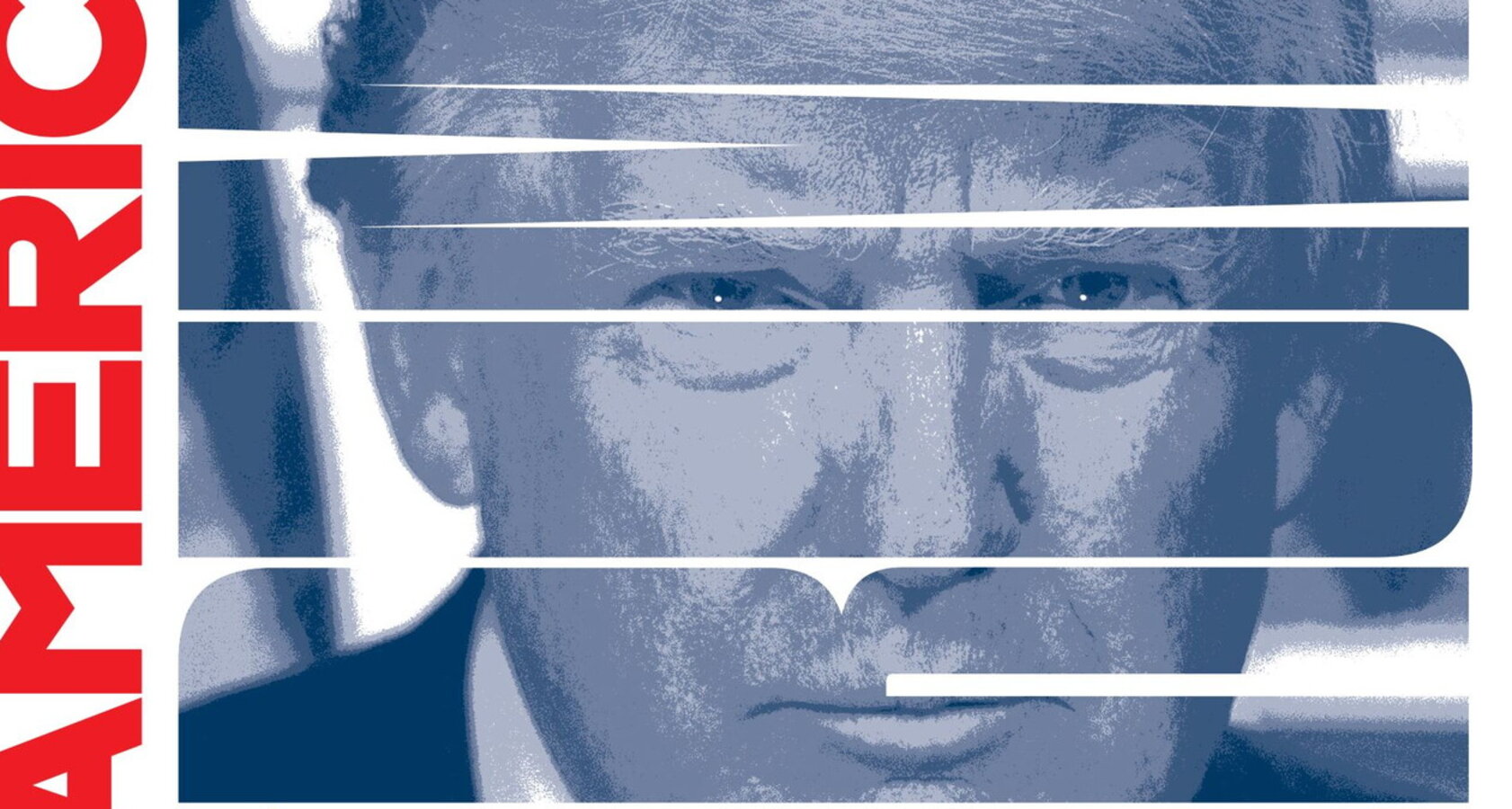

A slogan

MAGA 2025, a tonic for the USA

Trump’s second term promises plenty of fireworks, driven by a vision of America as a business. With ‘animal spirits’ running through the government, his administration promises to embody an entrepreneurial character. The final outcome, however, remains to be seen

6 minW

ith his victory in the U.S. election, Donald Trump returns to center stage with a “Colbert-Keynes” economic playbook—a potent mix of protectionism, geopolitical brinkmanship, and domestic stimulus. His administration’s push for more industry, abundant energy, and a strong dollar promises to upend the (previously cautious) American policy framework, clearing major obstacles in its path.

Maximizing America

The new president’s style is no mystery: a disdain for political equilibrium and a penchant for frequent turnover in key roles. In his last term, 90 percent of government positions changed at least once—often in chaotic fashion. His new administration resembles a corporate boardroom more than a political cabinet. Elon Musk leads the Department of Government Efficiency (DOGE—yes, like the meme and cryptocurrency). Scott Bessent, the legendary hedge fund manager known for his role in the 1992 attack on Sterling, will serve as Treasury Secretary. Vivek Ramaswamy, a vocal critic of ‘woke capitalism,’ rounds out a team that doubles as the highest-earning governing body in history. Trump’s economic strategy is simple: maximize America. It centers on boosting domestic manufacturing, ramping up energy production, maintaining a strong dollar to curb imported inflation, and enforcing a trade policy that leaves both rivals and allies on edge. Energy is central to his strategy. During Trump’s first term, oil production rose by 39 percent (from 9 to over 12 million barrels per day in just four years, an unmatched growth record in the industry), while gas production grew by a more modest 27 percent—also unprecedented.

With LNG production already increasing tenfold under his leadership, Trump aims to solidify U.S. energy dominance, free from the restrictions recently imposed by President Biden

A Texas wildcatter plan that embraced the tight oil and shale gas boom inherited from the Obama administration, but with surprisingly positive spillover effects on emissions. Despite expectations that withdrawal from the Paris Agreement would spell the end for climate progress, U.S. emissions decreased from 4.84 (2016) to 4.74 billion (excluding the Covid 19 year). However, emissions intensity per unit of GDP decreased from 0.28 tons per 1,000 dollars to 0.26 (-7.1 percent). Not bad for a president often seen as green-averse (excluding, of course, greens of the golfing variety).

W

ith LNG production already increasing tenfold under his leadership, Trump aims to solidify U.S. energy dominance, free from the restrictions recently imposed by President Biden.

Alongside the U.S. boom, there will be cautious dialogue with Gulf states (and a few threatening tweets before OPEC summits), along with increased pressure on Iranian oil production. In recent years, this has included expanding the trade embargo imposed on Tehran during Trump’s first term. MAGA’s other major growth driver is domestic industrial development, reshoring, and reducing the trade deficit—a true obsession.

Much of Donald II’s government will focus on reshaping the country’s trade flows, imposing or threatening tariffs even on allies and potential competitors, while reaffirming the dollar’s central role in global trade.

During his first term, a trade war with China became the hallmark of foreign policy—a real-world application of Thucydides’ Trap in commerce, in stark contrast to European policy.

With tariffs on hundreds of billions of dollars in goods, Trump aimed to reduce the trade deficit with Beijing. The plan succeeded to some extent, with the trade deficit, which had reached USD 419 billion in 2018 (2 percent of GDP), falling to 1.6 percent in 2019.

Today, the gap is even smaller, with a USD 279 billion deficit, nearing 1 percent—a level not seen since the early 2000s. In fact, there is little real criticism of this issue.

However, the new president’s early announcements signal a fresh set of measures with greater geopolitical significance, along with continued pressure on reshoring—from 10 percent tariffs on all goods to the potential removal of China’s Most Favored Nation status.

Colbertian policy and Keynesian leverage

Even allies aren’t spared from Colbert’s policies. In his last term, Trump imposed tariffs on steel and aluminum from Europe, prompting a retaliation that underscored the pressure the Old Continent could apply: a counter-tax on jeans and peanut butter. Nonetheless, the measure was effective in keeping the trade deficit with Europe steady at around 0.8 percent of GDP.

Finally, the most powerful lever: a Keynesian fiscal policy aimed at stimulating domestic growth. In the previous round, tax reform—cutting corporate taxes from 35 percent to 21 percent in 2017—was one of the administration’s most popular tools and triggered an economic boom. Between 2016 and 2019, GDP surged to over USD 21 trillion, growing at an annual rate of 4.6 percent. Unemployment dropped to full employment levels (from 5 percent to 3.5 percent), and the S&P 500 and Nasdaq indices soared by 50 percent and 90 percent, respectively.

But the balance between success and disaster is precarious: ‘You have to bet big to win big,’ and the budget deficit ballooned from USD 600 billion to over USD 1 trillion, eventually reaching astronomical levels during the pandemic. Today, the trend continues to rise, though at a slower pace than during the Covid-19 period.